- Adjusted EBITDA loss improved by 20% from previous quarter to $1.3 million compared to $1.7 million in the previous quarter

- Entered into a $3.5 million revolving line of credit to support working capital and expansion requirements

- Expanded services to veterans, RCMP and first responders with the acquisition of the operating assets of IRP Health Ltd.

TORONTO, ON, November 24, 2022 – Pathway Health Corp. (TSXV: PHC) (Frankfurt: KL1) (formerly Colson Capital Corp.) (“Pathway” or the “Company”), a Canadian leader in chronic pain solutions and management services, is pleased to report its financial results for the three and nine-month period ended September 30, 2022. Unless otherwise noted, all amounts are in Canadian dollars and are prepared in accordance with International Financial Reporting Standards (“IFRS”).

“We remain committed to our goals to support a patient’s journey to wellbeing through a comprehensive suite of services and products from both traditional and alternative sources of medicine. In the third quarter, we have taken another step toward achieving these goals with the acquisition of the operating assets of IRP Health Ltd., a multidisciplinary pain management and physical therapy program that will allow us to better serve at-risk patient groups such as veterans, RCMP and first responders,” said Ken Yoon, Pathway’s Chief Executive Officer. “We are excited about the Company’s path forward, as it looks to continue to expand its service offerings to these patient groups in need throughout Canada and potentially international markets.”

Recent Highlights

- Adjusted EBITDA loss improved by 20% from previous quarter to $1.3 million compared to $1.7 million in the previous quarter, reflecting management’s continued focus on streamlining operations and cash conservation measures.

- The Company expanded its MCMS (Medical Cannabis Management System) program with the addition of Sunshine Drugs family of 15 community pharmacies, bringing it’s collaborative agreements to over 2,000 pharmacies.

- In the second quarter 2022, Company entered-into a bridge loan with a related party for available proceeds of up to $1.0 million. This facility was rolled into a larger $3.5 million revolving line of credit in the third quarter 2022, providing the Company a foundation to support operations and future growth.

- Acquired IRP Health Ltd., expanding services to at risk patient groups, including veterans, RCMP and first responders. This acquisition is a key step forward in the Company’s strategy to focus on providing services and products to specialty groups of patients.

- The Company appointed MNP LLP as its new auditors in anticipation of future key changes to the business, including the approval of a non-possession sales license which is currently under review with Health Canada and potential international expansion.

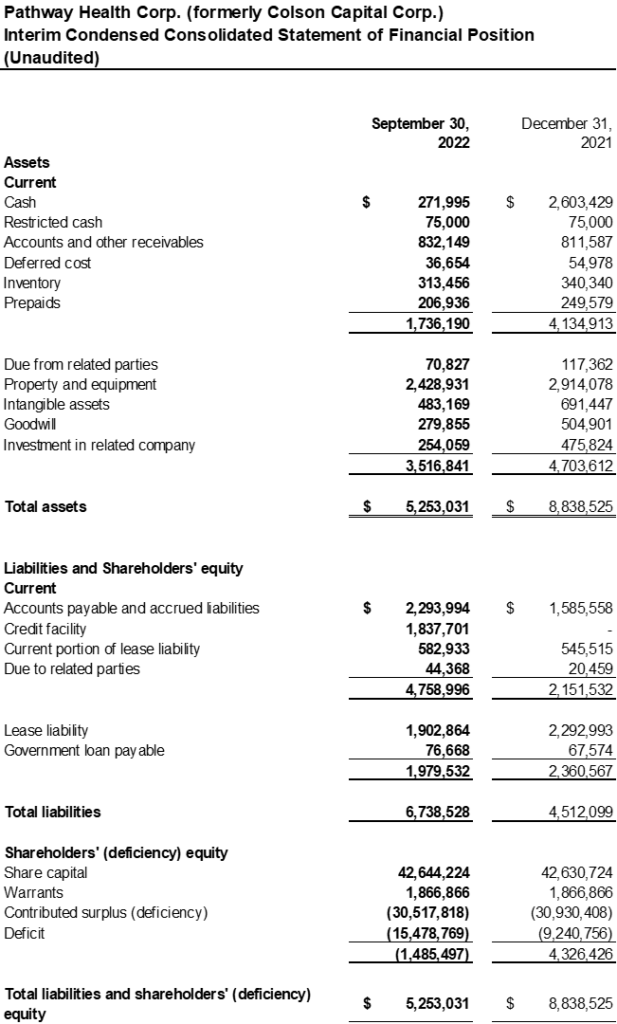

Summary of the Results for the Three Months Ended September 30, 2022 (Q3 2022) compared to the Three Months Ended September 30, 2021 (Q3 2021), unless otherwise noted

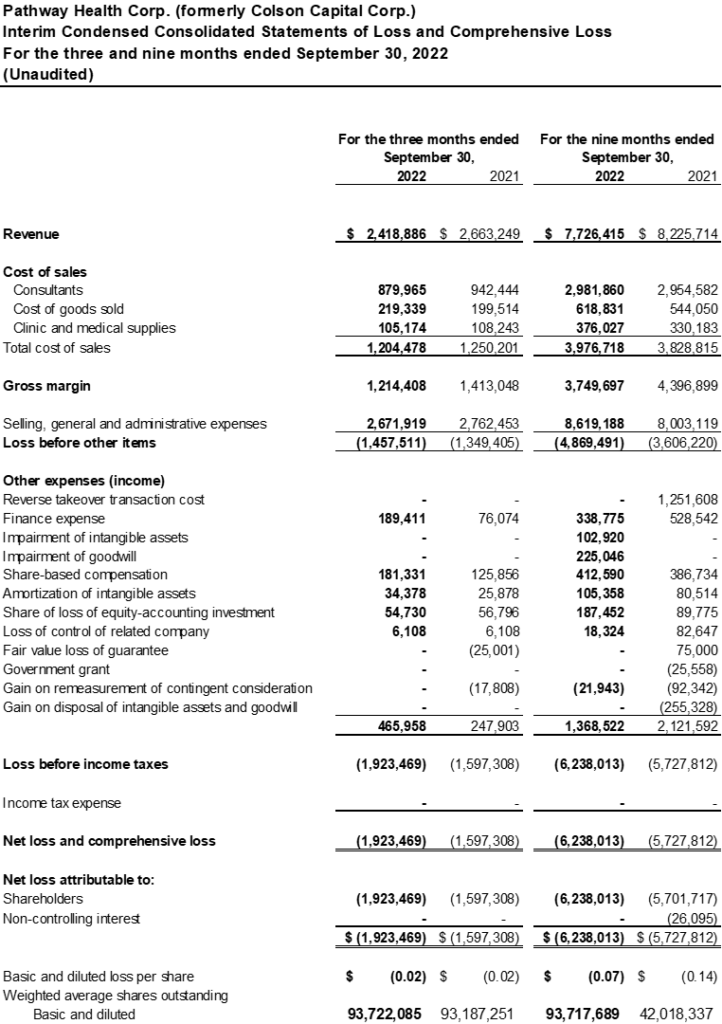

Revenues were $2.4 million and $2.7 million for the three months ended September 30, 2022, and 2021, respectively. Cannabis education revenues were partially impacted by a reduction in marketing fees previously provided by licensed producers as clinics moved to a telemedicine platform. The decline in revenue also reflects the continued downward trend in the Canadian medical cannabis market. However, the Company hopes to offset this by focusing on specialty group markets and offering more comprehensive services to these targeted markets.

Gross margins were $1.2 million and $1.3 million for the three months ended September 30, 2022, and 2021, which represented 50% and 53% of gross revenues, respectively. The difference is mainly a result of the increase in products and provincially insured and non-insured physician services as a total percentage of overall revenue compared to the same prior year period.

Selling, general and administrative expenses (“SG&A”) were $2.7 million and $2.8 million for the three months ended September 30, 2022, and 2021, respectively. The combined decrease in wages and benefits, marketing, public company costs and expenses totaled $0.2 million as a result of continued cost cutting and streamlining measures taken on by management. This was offset by a $0.04 million increase in professional fees due to additional costs related to the change in auditors and an increase of $0.03 million in rent and utilities reflecting the physical expansion in 2022.

The Company incurred a net loss of $1.9 million and had a basic and diluted loss per share of $0.02 for the three months ended September 30, 2022, compared to a net loss of $1.6 million and a basic and diluted loss per share of $0.02 for the same period prior year.

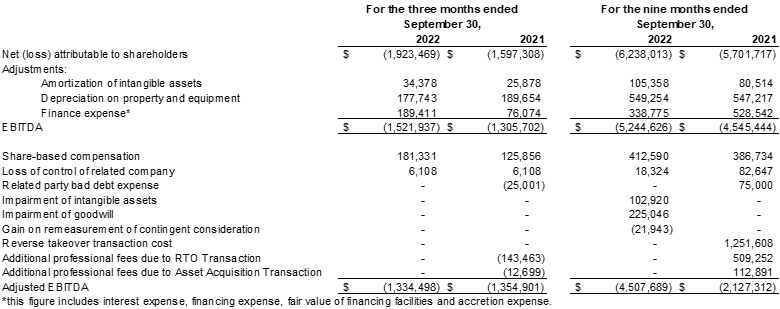

Earnings before interest, tax, depreciation, and amortization (“EBITDA”)1 was a loss of $1.5 million and adjusted EBITDA1 was a loss of $1.3 million for the three months ended September 30, 2022, compared to an EBITDA and adjusted EBITDA loss of $1.3 million and $1.4 million respectively in the prior year.

Cash as of September 30, 2022, was $0.3 million compared with $2.6 million on December 31, 2021. As of September 30, 2022, the Company had a principal balance of $1.9 million outstanding from its Credit Facility. As of November 23, 2022, the Company had a principal balance of $2.8 million outstanding from its Credit Facility.

1Non-IFRS financial measures

The non-IFRS measures included in this MD&A are not recognized measures under IFRS, and do not have a standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers. When used, these measures are defined in such terms as to allow the reconciliation to the closest IFRS measure. These measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from its perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. Despite the importance of these measures to management in goal setting and performance measurement, these are non-IFRS measures that may be limited in their usefulness to investors.

Management uses non-IFRS measures, such as EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of the Company’s operating performance and thus highlight trends in the Company’s core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management also believes that securities analysts, investors, and other interested parties frequently use non-IFRS measures in the valuation of issuers. Management also uses non-IFRS measures to facilitate operating performance comparisons from period to period, prepare annual operating budgets, and to assess the Company’s ability to meet its future debt service, capital expenditure and working capital requirements. The definition and reconciliation of EBITDA and Adjusted EBITDA used and presented by the Company to the most directly comparable IFRS measures follows below:

EBITDA and Adjusted EBITDA

EBITDA is defined as net (loss)/income adjusted for income tax, depreciation of property and equipment, amortization of intangible assets, interest on long-term debt and other financing costs, interest income, and changes in fair values of derivative financial instruments. Management uses EBITDA to assess the Company’s operating performance. Adjusted EBITDA is defined as EBITDA adjusted for, as applicable, share-based compensation, loss of control of related company, fair value loss of guarantee, impairment of intangible assets, impairment of goodwill, gain on remeasurement of contingent consideration, reverse takeover transaction costs and additional professional fees due to the reverse takeover transaction and Asset Acquisition Transaction costs. We use Adjusted EBITDA as a key metric in assessing our business performance when we compare results to budgets, forecasts, and prior years. Management believes Adjusted EBITDA is a good alternative measure of cash flow generation from operations as it removes cash flow fluctuations caused by non-cash expenses, or extraordinary and non-recurring items, including changes in working capital. A reconciliation of net (loss)/income to EBITDA (and Adjusted EBITDA) is set out below:

For further information, please contact:

Robin Cook

Corporate Development

(416) 809-1738

[email protected]