- Q1 2022 revenues came in at $2.5 million despite the reintroduction of pandemic restrictions.

- We will be working with our pharmacy partners to launch the medical cannabis programs in the upcoming quarters.

TORONTO, ON, May 20, 2022 – Pathway Health Corp. (TSXV: PHC) (Frankfurt: KL1) (formerly Colson Capital Corp.) (“Pathway” or the “Company”), a Canadian leader in chronic pain solutions and management services, is pleased to report its financial results for the three-month period ended March 31, 2022. Unless otherwise noted, all amounts are in Canadian dollars and are prepared in accordance with International Financial Reporting Standards (“IFRS”).

“During the first quarter, the Company concentrated on streamlining its operations to effectively manage resources. We continue to review and develop our patient retention and acquisition strategies and look forward to being able to leverage these changes in future quarters,” said Ken Yoon, CEO of Pathway.

Financial and Operational Highlights

- Revenues were at $2.5 million this quarter despite the reintroduction of more restrictive COVID-19 measures in a number of provinces. Since the lifting of these restrictions, the Company has seen improvements in revenue in the more recent months.

- The Company remains focused on patient care, adding in two more physicians to the team of specialists at Silver Pain Centre and an additional fluoroscopy suite. These additions will allow the Company to offer additional treatment options for patients suffering from chronic pain.

- The Company continues to expand on our preeminent partnership position with some of the leading retail pharmacy companies in the country, as we launch the Medical Cannabis Management System in pharmacy locations across Canada.

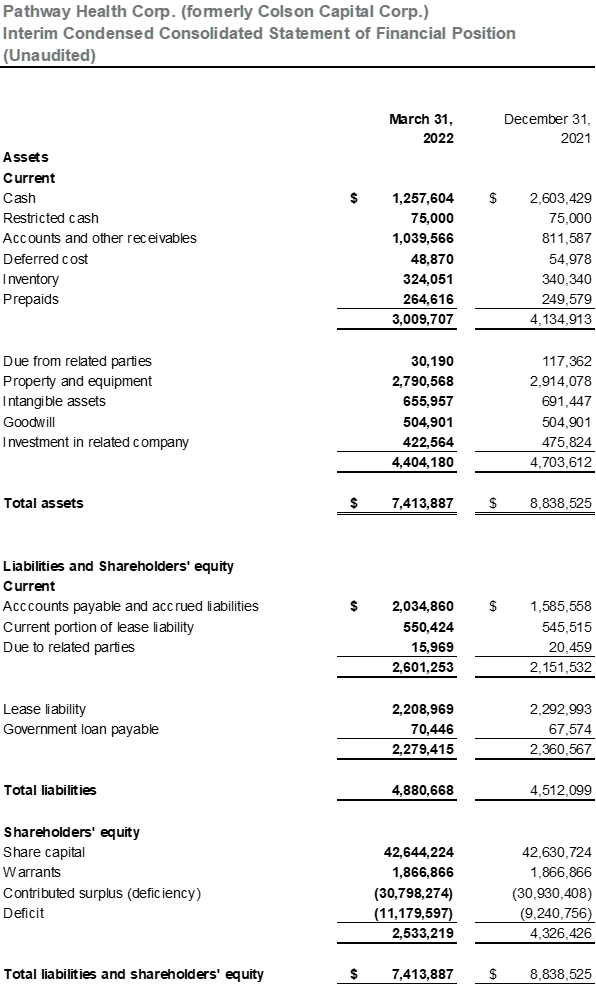

Summary of the Q1 2022 Financial Results

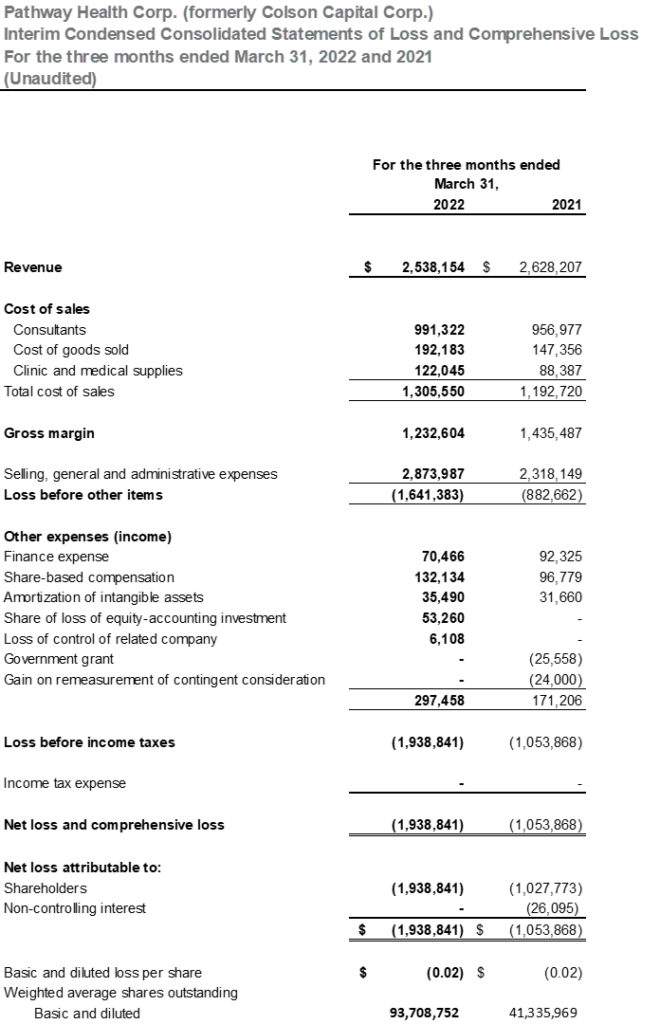

Revenues were $2.5 million and $2.6 million for the three months ended March 31, 2022 and 2021 respectively. The 2021 figures were impacted by the Asset Acquisition Transaction that closed January 18, 2021, prior to which the Company had no revenue generating assets. The Company was particularly impacted by the reinstated COVID-19 restrictions. Furthermore, cannabis education revenues were impacted by a reduction in marketing fees previously provided by licensed producers as the related clinics moved to a telemedicine platform.

Gross margins were $1.2 million and $1.4 million for the three months ended March 31, 2022, and 2021, which represented 49% and 55% of gross revenues respectively. The variance is mainly a result of the increase in products and provincially non-insured physician services as a total percentage of overall revenue.

Selling, general and administrative expenses (“SG&A”) were $2.9 million and $2.3 million for the three months ended March 31, 2022 and 2021 respectively. The 2021 figures were impacted by the Asset Acquisition Transaction that closed January 18, 2021, prior to which the Company had minor activities. The $0.4 million increase in wages and benefits and $0.1 million in office expenses over the prior year period are consistent with the growth of the operations of the Company as it explores other potential avenues of business including cannabis health products and the international cannabis markets. Public company costs have increased by $0.1 million over the prior year comparable as the Company began trading on the TSXV on June 17, 2021. This is offset by a $0.2 million reduction in professional and consulting fees, which were unusually high in the prior year as they reflect the additional listing fees, legal and professional fees related to the Reverse Takeover transaction which closed on May 31, 2021.

The Company incurred a net loss of $1.9 million and had a basic and diluted loss per share of $0.02 for the three months ended March 31, 2022 compared to a net loss of $1.0 million and a basic and diluted loss per share of $0.02 for the same prior year period.

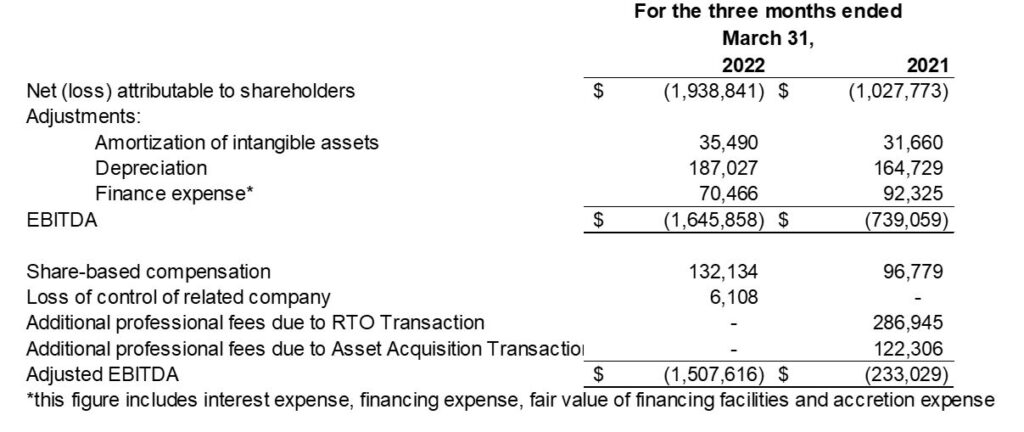

Earnings before interest, tax, depreciation and amortization (“EBITDA”)1 was a loss of $1.6 million and adjusted EBITDA1 was a loss of $1.5 million for the three months ended March 31, 2022, compared to an EBITDA loss of $0.7 million and $0.2 million in the prior year.

Cash as of March 31, 2022 was $1.3 million compared with $2.6 million on December 31, 2021. The Company is currently discussing a draw-down debt facility with its largest shareholder.

1Non-IFRS financial measures

The non-IFRS measures included in this MD&A are not recognized measures under IFRS, and do not have a standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers. When used, these measures are defined in such terms as to allow the reconciliation to the closest IFRS measure. These measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from its perspective. Accordingly, they should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. Despite the importance of these measures to management in goal setting and performance measurement, these are non-IFRS measures that may be limited in their usefulness to investors.

Working capital is a non-IFRS measure calculated as current assets less current liabilities. This measure is used to assist management and investors in understanding liquidity at a specific point in time. Management uses non-IFRS measures, such as EBITDA and Adjusted EBITDA to provide investors with a supplemental measure of the Company’s operating performance and thus highlight trends in the Company’s core business that may not otherwise be apparent when relying solely on IFRS financial measures. Management also believes that securities analysts, investors and other interested parties frequently use non-IFRS measures in the valuation of issuers. Management also uses non-IFRS measures in order to facilitate operating performance comparisons from period to period, prepare annual operating budgets, and to assess the Company’s ability to meet its future debt service, capital expenditure and working capital requirements. The definition and reconciliation of EBITDA and Adjusted EBITDA used and presented by the Company to the most directly comparable IFRS measures follows below:

EBITDA and Adjusted EBITDA

EBITDA is defined as net (loss)/income adjusted for income tax, depreciation of property and equipment, amortization of intangible assets, interest on long-term debt and other financing costs, interest income, and changes in fair values of derivative financial instruments. Management uses EBITDA to assess the Company’s operating performance. Adjusted EBITDA is defined as EBITDA adjusted for, as applicable, share-based compensation, loss of control of related company, additional professional fees due to reverse takeover (“RTO”) transaction the Asset Acquisition Transaction. We use Adjusted EBITDA as a key metric in assessing our business performance when we compare results to budgets, forecasts and prior years. Management believes Adjusted EBITDA is a good alternative measure of cash flow generation from operations as it removes cash flow fluctuations caused by non-cash expenses, or extraordinary and non-recurring items, including changes in working capital. A reconciliation of net (loss)/income to EBITDA (and Adjusted EBITDA) is set out below:

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive applicable approvals; and the results of operations. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Pathway disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

For further information, please contact:

Robin Cook

Corporate Development

(416) 809-1738